Profit First: A better way to manage finances (Book review)

How we improved company culture by 500% in 7 months (and what happened after)

November 23, 2019Profit First: A better way to manage finances (Book review)

As anyone knows that follows my books reviews on Instagram, I have always loved simple ideas that make a big positive impact. This article is about just such an idea:

Image Credit: Campaign US

Many people know the dreaded feeling when a bill comes in. Maybe it hit you off guard, maybe you knew it would be coming but just chose to avoid thinking about it.

By the time the bill arrives, you have already spent the money, so now you have to tap into your already minuscule savings, diminishing them even further.

As a business owner, I know this feeling all too well. There was a period when every tax bill would cause me great stress. I knew the tax bill would be coming, but I chose the path of “I’ll just reinvest this money into the business now and will take care of the tax bill when it comes”. Needless to say, when the tax bill came, and it always came, I felt stressed and frustrated.

At some point, I told myself: No MORE! And you know what? It’s a great feeling when a bill comes in and you’ve prepared!

I never thought I’d be excited about an accounting book, but Profit First by Mike Michalowicz addresses exactly this issue. It talks about such a simple idea that can have life-changing benefits!

Profit First book by Mike Michalowicz

The method actually works really well for both business and personal finances. So I have renamed it for this article to “Cash Flow First” to encompass both areas.

Why is it life-changing? It is a simple idea to help you SAVE MORE and have LESS STRESS in regards to your finances. The book talks about two main ideas:

- Instead of saving at the end of the month when all bills have been paid, save at the beginning of the month

The main way most people live is like this:

Salary – Expenses = Savings

Business Owners: (Profit – Expenses = Savings)

Most people start off the month like this:

Foto Credit: ImageFlip

And end like this:

Foto Credit: The Irish Times

With Profit First, you flip it to work like this:

Salary – Savings = Expenses

Business Owners: Profit – Savings = Expenses

Hmmm…. What difference does it make?

It’s all in the mind – and it works! Because you have your savings banked in first.

That’s your priority, rather than crossing your fingers that something is left over each month.

2. Instead of having one account for savings, have several savings accounts separated by financial need

Most people/businesses have one savings account and take whatever profit is left at the end of the month from that account.

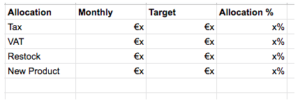

The second brilliant idea of the book is to create savings accounts for each financial need you have. This system is so simple but helps to work out expenses, plan a savings amount without having to think about it as it’s all planned in.

For business owners, this might mean a VAT account, TAX account, Owner’s Salary account, Account for restocking or reinvesting in the business etc.

For personal, this could mean a sub-account for holidays, taxes, repairs, rent etc.

This method does require that you sit down and calculate your budget requirements for the next couple of months.

As a business, you need to estimate how much revenue you’ll make, and thus how much you should set aside for VAT, for operating income, for taxes, for reinvestments into the business (such as new product development, restocking, new hires) and any other areas you may have.

That is what we call your “target amount” for each of your financial needs. Now you can calculate backwards and get your respective target allocation, for example:

- 19% VAT

- 23% Reinvestment

- 7% Tax

So each time you receive income, you put a part of it into savings immediately. But not only into one account, but you split it into your sub-accounts using the respective percentage amounts.

For personal finance, it could look like this:

So let’s say you earn €2000 a month

€500 on rent – so that’s 25% allocation

€250 savings – so that’s 12.5% allocation

€20 mobile phone bill…1%

Hopefully, you get the idea. Simply life-changing for me. I liked the book because I love simple powerful ideas. Only one caution: Because the main idea is simple, you have to get through some fluff when you read the book (he had to make a whole book out of one simple idea afterall)

In the book, Mike Michalowicz recommends different bank accounts but I find for personal finance the N26 spaces work really well (#notsponsored).

Source: N26.com

For business, I use a simple excel sheet because my business bank does not offer sub accounts and changing bank accounts feels a bit inconvenient. Having used the Profit First method for one month now, I definitely like the N26 version better than the excel version, so I am considering moving to a bank account like Holvi that offers sub accounts for Businesses at €18 per month (#notsponsored).

This is how my excel sheet looks like

I think people do not talk about finance enough – especially women! – as it is seen to be “not sexy”, “capitalist” or even “dirty”. So let’s make finance great again!

If you know anybody who should read this, please share/forward this article.

Let’s talk about these things with our friends and business partners and make financial literacy a “cool” topic again.